-

Image

Solutions

A wide range of efficient products

that enhance business opportunities.

-

Image

Governance

Driven by our purpose.

Guided by our values.

-

Image

Investors

Keeping our investors informed.

Latest results.

-

Image

Sustainability

Committed to people, the planet

and the prosperity of Latin America.

-

Image

Culture

A diverse team from 15+ countries, 52/48 gender balance, 40+ years of experience

-

Image

News

Relevant information

and recent events.

-

Image

About us

We specialize in offering trade solutions

in Latin America and the Caribbean

-

in business for more than00years

-

listed on NYSE00years

-

our clients are from over00countries

-

diverse team from over00nationalities

-

gender balance00 / 100Male/Female

Bladex

Banco Latinoamericano de Comercio Exterior

Headquartered in Panama, with 5 offices in the continent and solid business relationships managed by professionals from 16 countries, provides financial solutions to top-tier corporations in multiple industries. With more than four decades serving the region, Bladex is the result of the collective vision of businessmen and local leaders who set out to facilitate and strengthen the commercial connection of all Latin America with the support of Central Banks and other governmental entities from 23 countries of the Region as founding shareholders.

As the first Latin American bank and first Panamanian company listed on the New York Stock Exchange, at Bladex we continuously and permanently promote the market to which we owe ourselves.

Bladex Investor Day

Learn more about our business and sustainable

growth strategy, and market opportunities.

Includes presentations by the management team

and a Q&A session.

Event Video

>

Check out our 2Q 2025 results

Monday, August 4, 2025

Bladex's Second Quarter Earnings Release will be announced after the market closes.

Join our interactive meeting

Tuesday, August 5, 2025

Starting at 11:00 a.m. Eastern Time

News

-

CLACE 2025: Latin America Facing a New Global Trade Landscape

July 11, 2025Gustavo Acero, AVP of Economic Studies at Bladex, shares his perspective at CLACE 2025 on how the region can strengthen its role on the international stage.

-

Bladex ranks in Bloomberg's Syndicated Loans League Table

July 3, 2025Bloomberg places Bladex in the top 8 syndicated loan arrangers in Latin America for the first half of 2025.

-

Bladex Leads USD 120 Million Syndicated Loan for Sudameris Bank

July 3, 2025The transaction will allow Sudameris to accelerate its expansion in Paraguay by broadening financing options for SMEs and corporations.

-

Bladex and Silver Birch: Alliance to Finance Working Capital in LatAm

May 29, 2025The collaboration between the two institutions aims to fill the gap in foreign trade financing in the region through innovative and flexible financial products tailored to current market needs.

-

Bladex Acts as Global Coordinator and Mandated Lead Arranger for Staatsolie

May 22, 2025Bladex and Afreximbank, alongside with other 16 financial institutions have reached an agreement with Staatsolie a US$1.6 billion long-term senior secured financing facility.

-

Bladex and the Panama Canal: an alliance that connects and transforms

May 2, 2025Bladex in partnership with the Panama Canal and with the support of the Botellas de Amor Foundation, officially inaugurated a bridge rebuilt with recycled plastic waste.

-

Bladex and Scotiabank lead US$100 million loan for EGE Haina

March 13, 2025The syndicated loan follows the Green Loan Principles (GLP) guidelines of the Loan Market Association (LMA) and the Loan Syndications and Trading Association (LSTA).

-

Bladex leads a new USD 200 million syndicated loan for CrediQ

March 12, 2025This is the second syndicated loan led by Bladex for CrediQ. It consolidates a relationship of trust and financial support that began in 2021.

-

Bladex promotes the Marea Verde Seven Basins Project

March 11, 2025A multi-sector initiative led by the Marea Verde Foundation in partnership with the prestigious international organization The Ocean Cleanup.

-

Bladex Achieves Record Financial Results and Increases Dividend by 25%

February 27, 2025We announce our financial results for the fourth quarter and full year 2024, achieving historic levels of profitability and business growth.

-

The Panama Canal and Bladex have signed an alliance for sustainable development

February 24, 2025This strategic partnership will directly benefit the communities within the Panama Canal watershed through the implementation of collaborative social and environmental initiatives.

-

Bladex and BTG Pactual lead new credit facility for GeoPark Colombia

February 25, 2025At the end of 2024, Bladex and BTG Pactual led the second syndicated committed credit facility for GeoPark, amounting to US$100 million.

-

Bladex receives the Great Place to Work certification

January 28, 2025For the third consecutive year, Bladex is recognized as a great place to work, demonstrating its commitment to professional development, diversity, and employee well-being.

-

Bladex and Finanzauto Close ESG Syndicated Loan

January 22, 2025Bladex has announced the successful closing of a US dollar and Colombian peso syndicated loan for US$53 million and COP 60,000 million, respectively, for Finanzauto S.A. BIC.

-

Bladex´s 2023 Sustainability Report 2023

December 3, 2024We reaffirm our commitment to sustainability in the 2023 Report, showcasing progress in environmental, social, and governance integration to create value in the region.

-

We announce our financial results for the third quarter of 2024.

October 29, 2024Bladex announces 3Q24 Net Profit of $53.0 Million, or $1.44 per share; annualized return on equity of 16.4% in 3Q24

-

Bladex strengthens its team with Sergio Olarte as Chief Economist

October 9, 2024Bladex continues to consolidate its position as a key player in the economic development of Latin America and the Caribbean with the addition of Sergio Olarte, a renowned economist with more than 24 years of experience.

-

Bladex Continues its Expansion in the Mexican Market

July 22, 2024With over 24 years of experience in Mexico, we are advancing our strategy to further strengthen our presence in the country.

-

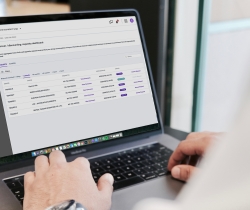

Bladex Selects CGI as Trade Finance Partner with CGI Trade360® Platform

July 18, 2024Bladex will become the first bank headquartered in Latin America to implement the CGI Trade360 platform, a platform utilized by global banks to support trade finance in over 85 countries across Asia, Europe, North America, and Oceanias.

-

Bladex lidera estructuración de crédito sindicado para Interceramic

June 28, 2024Anunciamos la estructuración exitosa de un crédito sindicado por US$665 millones, para Internacional de Cerámica, SAB de CV.

-

Bladex leads second successful syndication for Forum

June 14, 2024Bladex announced the successful closing of a US$100 million senior unsecured syndicated up to 3 years for Forum Servicios Financieros, S.A.

-

Bladex leads successful syndication for Banco Promerica

June 17, 2024Bladex announced the closing of a US$100 million three-year syndicated facility in favor of the Guatemalan bank Banco Promerica, S.A.

-

We celebrate a year of success at Bladex

April 20, 2024On April 17th, Bladex held its Annual Shareholders' Meeting in Panama City, during a record-breaking year for the Bank.

-

2024 Annual Meeting of Shareholders

March 19, 2024Bladex announces its 2024 Annual Meeting of Shareholders to be held on April 17, 2024, in Panama City, Republic of Panama.

-

Bladex achieves record results

March 4, 2024Bladex´s net income for 2023 was US$166.2 million, 81% higher than the previous year and a record for the bank. Jorge Salas, president of Bladex, pointed out that all relevant financial metrics show a positive trend with record annual figures for the bank.

-

Bladex's 2022 Sustainability Report

December 12, 2023We present a summary of our 2022 Sustainability Report, outlining our performance in the economic, social, and environmental performance, as well as our contribution to the Sustainable Development Goals."

-

Bladex acts as Joint Lead Arranger and Bookrunner for AES Dominicana Renewable Energy

November 30, 2023Bladex announced the successful closing of a US$368 million A/B Loan Facility and US$27 million associated Debt Service Reserve Letter of Credit Facility.

-

Bladex refuerza su compromiso con Colombia

November 27, 2023Bladex anunció su estrategia para ampliar y fortalecer su presencia en Colombia y contribuir, a través de su profunda experiencia y conocimiento de la región, en el financiamiento y expansión internacional de las empresas colombianas.

-

Bladex, TC Latam, and Toesca launch Greenbridge Capital

November 22, 2023Bladex, TC Latam and Toesca announce the launch of Greenbridge Capital, a regional private lending platform, whose first factoring vehicle will be funded by Bladex.

-

Bladex acts as joint lead arranger for Ecopetrol US$1bn term loan facility

September 13, 2023Bladex acted as Joint Lead Arranger and three additional financial institutions joined the facility including Deutsche Bank AG as Global Coordinator and Joint Lead arranger. The funds from the Facility will be used to fund Ecopetrol’s organic investment plan in 2023.

-

Bladex and BTG Pactual lead syndicated loan for GeoPark Colombia.

August 17, 2023Bladex and Banco BTG Pactual S.A. – Cayman Branch announced today the successful closing of a US$80 million 2-year Senior Unsecured Committed Facility for GeoPark Colombia S.A.S.

-

Financial Results: Second Quarter 2023

July 27, 2023In this second quarter of the year, our interest income reached US$160 million, reflecting a remarkable expansion of almost 150% year-over-year.

-

Transforming plastic waste to rebuild a bridge in Puerto Caimito, Panama

June 30, 2023Under the slogan "One Team, One Community, One World," the institution continues to work to promote sustainable development in Latin America and to reinforce its commitment to ESG principles.

-

Discover more about our strategic alliance with Komgo

May 25, 2023Don't miss the exclusive interview with our CEO, Jorge Salas, and Souleïma Baddi, CEO of Komgo, where they discuss in detail the importance of this alliance in promoting trade in the region.

-

SMV authorizes registration of bonds to Bladex for up to US$300M

March 29, 2023Bladex registered a new Corporate Bond Revolving Program for an amount of up to 300 million US dollars.

-

Fitch Assigns National Rating to Bladex

March 6, 2023Fitch Ratings has assigned Bladex long-term and short-term national ratings of 'AAA(pan)' and 'F1+(pan)'; respectively.

-

Bladex successfully leads the first syndication for Banco Guayaquil S.A.

December 27, 2022Bladex announced today the successful closing of a US$89 million 3-year Senior Unsecured Amortizing Facility for Banco Guayaquil S.A.

-

Bladex enters into a strategic alliance with Komgo

November 10, 2022Bladex has entered into a strategic alliance with Fintech company Komgo, becoming the first bank in Latin America to join this platform

-

Bladex successfully leads the fourth syndication for Favorita Fruit

November 7, 2022Bladex announced the successful closing of a US$130 million 7-year Senior Secured Amortizing Facility (the “Facility”) for Favorita Fruit Co. Ltd.

-

Bladex celebrates 30 years of listing on the NYSE

October 19, 2022The Latin American Bank for Foreign Trade (Bladex), was the protagonist of the traditional “bell” on the New York Stock Exchange, during the celebration of its 30th anniversary of listing on the NYSE.

-

More than 180 persons participate in Bladex volunteer project

October 1, 2022Over 1,100 pounds of plastic were collected by volunteers of Bladex, from the beaches and mangroves of the community of San José, popularly known as Kosovo, in the township of Puerto Caimito.

-

Bladex celebrates a successful track record of 10 years in the Mexican stock market

September 27, 2022Bladex recently celebrated 10 years of being part of the BMV Group, with its initial listing in March 2012 in this debt market.

Financial Solutions – Syndicated/Structured Loans

-

US$ 167,500,000

Senior Dual Tranche Facility

Sole Lead Arranger and BookrunnerChile -

US$ 151,500,000

Term Loan Facility

Joint Lead Arranger and BookrunnerMéxico -

US$ 59,000,000

Term Loan Facility

Sole Lead Arranger and BookrunnerPanama -

US$ 25,000,000

Term Loan Facility

Joint Lead ArrangerPeru -

US$ 50,000,000

Term Loan Facility

Sole Lead Arranger and BookrunnerPanama -

US$ 125,000,000

Term Loan Facility

Sole Lead Arranger and BookrunnerCosta Rica -

US$ 130,000,000

Secured Term Loan

Sole Lead Arranger and BookrunnerEcuador -

US$ 91,000,000

Term Loan Facility

Sole Lead Arranger and BookrunnerCosta Rica -

US$ 100,000,000

Term Loan Facility

Sole Lead Arranger and BookrunnerGermany -

US$ 85,000,000

Term Loan Facility

Joint Lead ArrangerBrazil -

US$ 40,000,000

Term Loan Facility

Joint Lead ArrangerPeru -

US$ 90,000,000

Dual-tranche Term Loan

Sole Lead Arranger and BookrunnerColombia/Peru/Ecuador -

US$ 67,000,000

Term Loan Facility

Sole Lead Arranger and BookrunnerPanama / Costa Rica -

US$ 50,000,000

Term Loan Facility

Co-Mandated Lead ArrangerBrazil -

US$ 100,000,000

Term Loan Facility

Sole Lead Arranger and BookrunnerMéxico -

US$ 130,000,000

Senior Credit Facility

Sole Lead Arranger and BookrunnerColombia -

US$ 100,000,000

Senior Term Loan

Co-Mandated Lead ArrangerGuatemala -

US$ 100,000,000

Senior Credit Facility

Co-Mandated Lead ArrangerPeru -

US$ 100,000,000

Term Loan Facility

Joint Lead ArrangerPanama / Costa Rica -

US$ 1,000,000,000

Acquisition Finance Term Loan

Joint Lead Arranger and BookrunnerEl Salvador -

US$ 50,000,000

Acquisition Finance Term Loan

Joint Lead Arranger and BookrunnerPanama -

US$ 50,000,000

Trade Finance Facility

Sole Lead Arranger and BookrunnerGuatemala -

US$ 150,000,000

Dual Tranche Term Loan

Joint Lead ArrangerCosta Rica -

US$ 100,000,000

A/B Senior Term Loan Facility

B-Loan Bookrunner and Joint Lead ArrangerParaguay -

US$ 135,500,000

Dual Tranche Term Loan

Joint Lead Arranger and BookrunnerPanama -

US$ 50,000,000

A/B Senior Term Loan

B-Loan Bookrunner and Joint Lead ArrangerParaguay -

US$ 119,500,000

Senior Dual Tranche Facility

Sole Lead Arranger and BookrunnerCosta Rica/ El Salvador -

US$ 130,000,000

Term Loan Facility

Joint Lead ArrangerArgentina -

US$ 75,000,000

Term Loan Facility

Joint Lead ArrangerArgentina -

US$ 120,000,000

Term Loan Facility

Sole Lead Arranger and BookrunnerCosta Rica -

US$ 60,000,000

Term Loan Facility

Joint Lead ArrangerPeru -

US$ 125,000,000

Term Loan Facility

Joint Lead Arranger and BookrunnerCosta Rica -

US$ 220,625,000

Term Loan Facility

Joint Lead Arranger and BookrunnerMéxico -

US$ 85,000,000

Term Loan Facility

Joint Lead Arranger and BookrunnerCosta Rica -

US$ 145,000,000

Term Loan Facility

Sole Lead Arranger and BookrunnerPanama -

US$ 130,000,000

Acquisition Finance Term Loan

Joint Lead Arranger and BookrunnerPanama -

US$ 102,000,000

Secured Amortizing Facility

Sole Lead Arranger and Bookrunner Administrative & Collateral AgentEcuador -

US$ 110,000,000

Secured Amortizing Facility

Sole Lead Arranger and Bookrunner Administrative & Collateral AgentEcuador -

US$ 122,500,000

Secured Amortizing Facility

Joint Lead Arranger and BookrunnerPanama -

US$ 50,000,000

Trade Finance Facility

Sole Lead Arranger and BookrunnerGuatemala -

US$ 40,000,000

Trade Finance Facility

Sole Lead Arranger and BookrunnerPanama -

US$ 100,000,000

Trade Finance Facility

Lead Arranger and BookrunnerPeru -

US$ 150,000,000

Dual Tranche Term Loan

Joint Lead ArrangerCosta Rica -

US$ 135,500,000

Dual Tranche Term Loan

Joint Lead Arranger and BookrunnerPanama -

US$ 223,000,000

Acquisition Finance Facility

Joint Lead Arranger and BookrunnerPanama -

US$ 105,000,000

Acquisition Finance Facility

Joint Lead Arranger and BookrunnerPanama -

US$ 60,000,000

A/B Term Loan Facility

Joint Lead ArrangerHonduras -

US$ 40,000,000

Secured, Trade Finance

Sole Lead Arranger and BookrunnerPeru -

US$ 120,000,000

Senior Secured Bridge Loan

Joint Lead ArrangerDominican Republic -

US$ 300,000,000

Senior Secured Term Loan

Joint Lead ArrangerBermuda / Guatemala -

US$ 720,000,000

Senior Secured Term Loan

Joint Lead ArrangerTrinidad and Tobago -

US$ 110,000,000

Secured Amortizing Facility

Sole Lead Arranger and BookrunnerEcuador -

US$ 70,000,000

Secured Amortizing Facility

Sole Lead Arranger and Bookrunner Administrative & Collateral AgentEcuador -

US$ 122,500,000

Secured Amortizing Facility

Joint Lead Arranger and BookrunnerPanama -

US$ 131,500,000

Acquisition Finance Bridge Loan

Joint Lead ArrangerEcuador / Panama -

US$ 249,301,000

Receivables Purchase Facility

Purchaser and ArrangerTrinidad and Tobago -

US$ 250,000,000

Bridge Loan Facility

Joint Lead Arranger and BookrunnerDominican Republic -

US$ 30,000,000

Dual-Currency Term Loan

Sole Lead Arranger and BookrunnerCosta Rica / Peru -

US$ 28,000,000

Senior Import Finance Facility

Sole Lead Arranger and Bookrunner Administrative & Collateral AgentBrazil -

US$ 125,000,000

Pre-Export Facility

Sole Lead Arranger and BookrunnerGuatemala -

US$ 225,000,000

Pre-Export Facility

Mandated Lead ArrangerBrazil

JORGE L. SALAS TAUREL

Chief Executive Officer

SAMUEL CANINEU

Executive Vice President - Commercial Banking

ANNETTE VAN HOORDE DE SOLIS

Executive Vice President - Chief Financial Officer

EDUARDO VIVONE

Executive Vice President - Treasury and Capital Markets

ALEJANDRO TIZZONI

Executive Vice President - Chief Risk Officer

JORGE LUIS REAL

Executive Vice President - Chief Legal Officer and Corporate Secretary

ADRIANA LIZZETH DÍAZ FORERO

Executive Vice President - Chief Audit Officer

OLAZHIR LEDEZMA

Executive Vice President - Strategic Planning

CARLOS DANIEL RAAD BAENE

Executive Vice President - Chief Investor Relations Officer

TATIANA CALZADA

Executive Vice President - Chief Compliance Officer

GERALDINE FRANCIS ABREU CUMARÍN

Executive Vice President – Technology & Operations (Chief Technology Officer)