Commodities: Gold has no ceiling, but the dollar's hegemony is not at risk

Sergio Olarte

Macro Reasearch Department

A/ Abstract

-

2025 has been,. Among other things, by uncertainty. Global trade tensions have been in the spotlight of financial markets and economic authorities, affecting asset prices.

-

Gold now represents more than a quarter of total central bank international reserves, reaching a level not seen in more than 25 years.

-

This does not mean that the dollar's global hegemony is at risk. However, we do see a moderation in its global demand, driven by increased demand for gold as a haven asset.

-

The dollar's dominance as the global reference currency remains firm, supported by the most recent data: it represents 40% of central bank international reserves, 44% of international transactions, and 58% of payments made through the Swift network.

-

Recent developments in financial markets reflect a shift in central bank and investor preferences in the face of global volatility.

B/ Key Considerations

2025 has been marked by uncertainty. Global trade tensions have kept busy financial markets and economic authorities, whether due to the adverse effects they generate or the opportunities they may offer. Off course, financial assets have not been immune to the situation.Prices and volatility show the changing dynamics of the environment.

Having said that, this volatility is not unique to 2025. Since the post-pandemic period, various events have contributed to an uncertain environment, making higher uncertainty the new normal in the markets: geopolitical conflicts, interest rate adjustments by central banks, global logistics and supply chain crises, as well as a busy electoral calendar in many advanced economies.

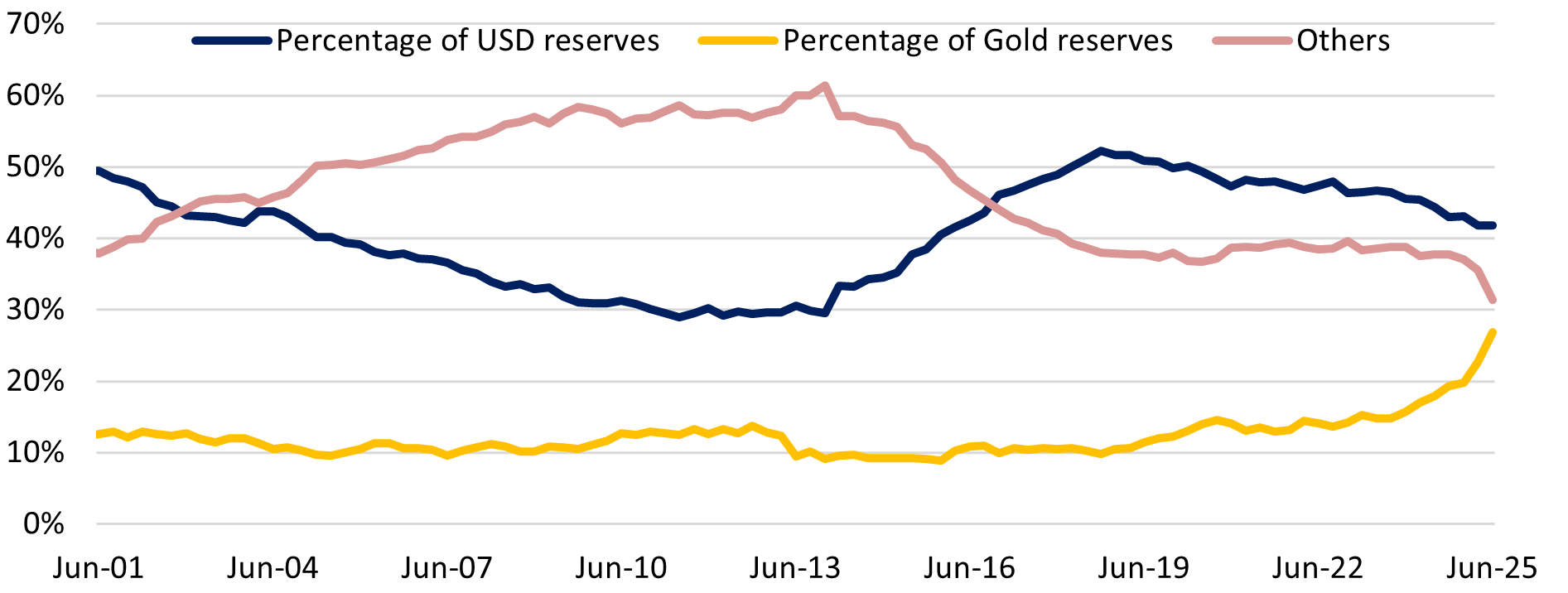

Chart 1: Gold and dollar share of global international reserves (%)

Source: World Gold Council - IMF – Bladex Economic Research.

Higher market volatility has led investors to seek haven assets to reduce risk in their portfolios. The most representative example is gold, which has historically served as a store of value during periods of heightened global uncertainty. Even central banks have adjusted their portfolios, increasing their gold holdings within international reserves.

The most recent data reveal that gold now represents more than a quarter of central banks' total international reserves, reaching a level not seen in more than 25 years. In contrast, the share of the dollar and especially other currencies of advanced economies has declined. The dollar's share of reserves stands at 42%, while that of other advanced currencies has fallen to around 30%. Twenty-five years ago, the dollar represented almost 50%, while advanced economy currencies represent almost 40%.

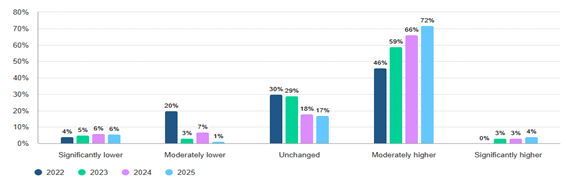

Chart 2: Central banks' expectations of what will happen to GOLD holdings in international reserves over the next 5 years (%)

Source: World Gold Council Survey - IMF – Bladex Economic Research.

Central banks' expectations suggest that gold's weight in international reserves will continue to increase, reflecting, among other factors, increased global uncertainty, the recent weakening of the dollar, and the recurring need to seek haven assets (Chart 2).

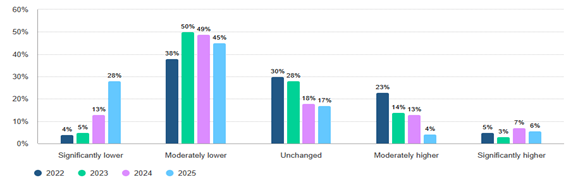

Chart3: Central banks' expectations of what will happen to DOLLAR holdings in international reserves over the next 5 years (%)

Source: World Gold Council Survey - FMI – Bladex Economic Research.

Central banks' strategy of increasing their gold reserves over the next five years contrasts with their expectations regarding the dollar (Chart 3). According to their projections, a moderate reduction in the US dollar's share of international reserves is anticipated over that period.

This does not mean that the dollar's global hegemony is at risk. What we are seeing is a moderation in its share, driven by increased demand for gold as a haven asset. The dollar's dominance as the global reference currency remains firm, supported by the most recent data: it represents 40% of central banks' international reserves, 44% of international transactions, and 58% of payments made through the Swift network.

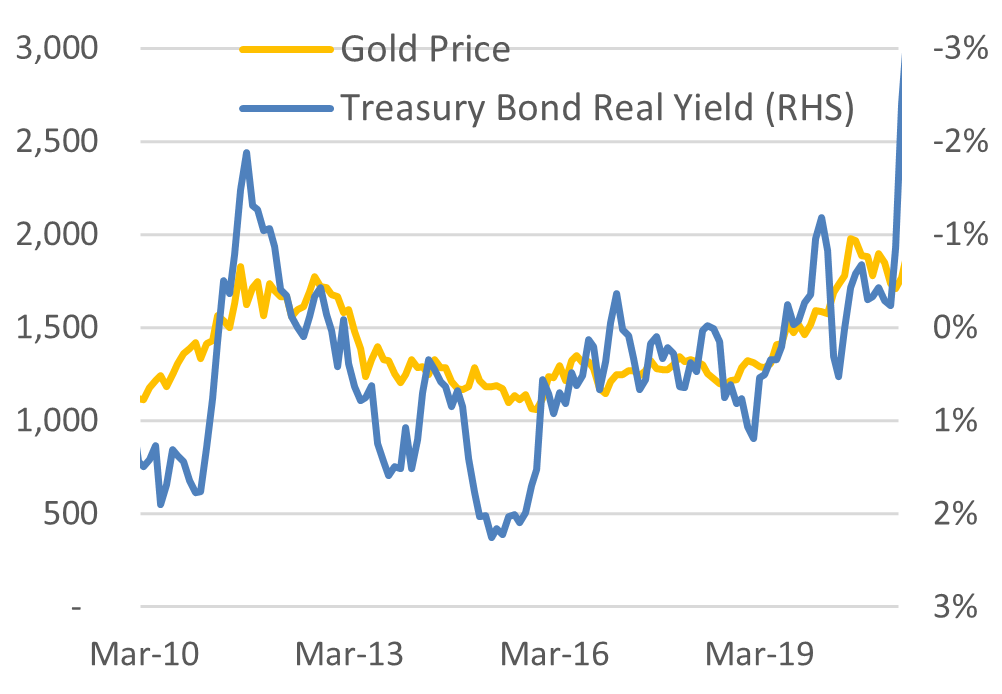

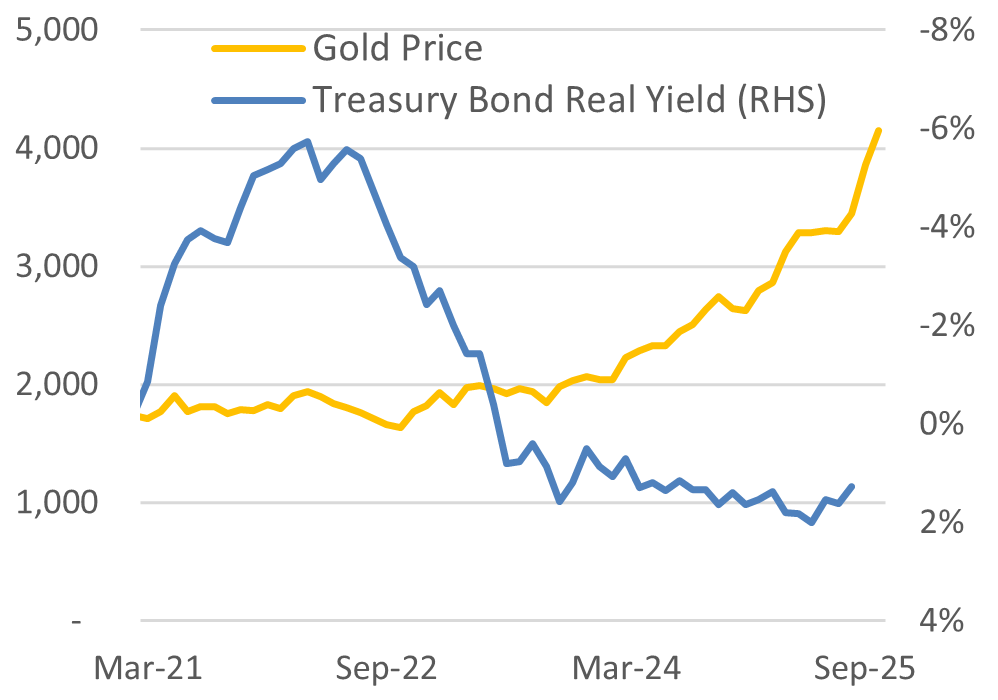

In this context, the recent market cycle has reflected a loss of relative attractiveness of the dollar compared to other safe-haven assets, without compromising its leadership in the foreign exchange market. This is evident in the performance of these assets (Chart 4). Traditionally, both gold and US Treasury bonds have been considered safe-haven assets, showing similar movements in times of stress. However, this correlation changed significantly after 2021. In recent episodes of volatility, the increase in demand for gold has not been accompanied by greater demand for Treasury bonds. Recent events in the United States, such as institutional deterioration perception, the deterioration of fiscal accounts, and trade tensions, have increased the risk premium on US debt and moderated demand for dollars worldwide. This raises the expectation that, while the dollar's hegemony as the currency par excellence will continue, competition from other currencies may tend to increase soon as a risk diversification mechanism.

Gráfico 4: Gold Price Troy Ounce vs. 10-Year Treasury Bond Real Yield

(USD per ounce, %)

Panel A: 2010 - 2021

Panel B: 2021 - 2025

Fuente: Bloomberg – Estudios Económicos Bladex.

Recent developments in financial markets reflect a shift in central banks' and investors' preferences in the face of global volatility. Gold has gained prominence as a haven asset, increasing its share of international reserves, although without compromising the dollar's dominant role in the global financial system. This transition does not signal, in our opinion, a loss of the dollar's hegemony, but rather a strategic diversification in the face of a more uncertain environment and rising demand for safe-haven assets.